Research Finder

Find by Keyword

AWS-Powered Red Hat TNC: 2026 Strategy to Win Hybrid Cloud Orchestration

AWS can host the centralized Red Hat TNC management cluster via ROSA, enabling the automated lifecycle orchestration of diverse workloads, including 5G Core, RAN, and AI-specific clusters, across both cloud and on-premises environments, aiming to win more telco business.

01/07/2026

Key Highlights

- The architecture prioritizes ROSA Classic to leverage the bare-metal operator, which is vital for the Zero Touch Provisioning (ZTP) of on-premises bare-metal hardware.

- To support disconnected telco sites, the system employs private ROSA clusters, AWS site-to-site VPNs, and S3 private interface endpoints to ensure sensitive container images and telemetry never touch the public internet.

- AWS competes against Microsoft Azure Operator Nexus’s deep infrastructure automation and Google’s AI-native RAN Guardian edge processing, alongside Project Sylva’s focus on European digital sovereignty.

- AWS maintains an edge through its 800G-ready infrastructure and custom silicon like the Tomahawk 6, positioning it as a key partner for telcos aiming to retire AI infrastructure debt through high-performance, power-efficient fabrics.

- The transition to ROSA with Hosted Control Plane (HCP) in early 2026 is expected to significantly reduce the operational tax on telco teams by offloading control plane management even for on-premises deployments.

The News

AWS enables the deployment of the TNC Management cluster through the Red Hat OpenShift Service on AWS (ROSA), a fully managed and jointly supported platform where Red Hat handles operations while leveraging AWS infrastructure. The platform is ready to bolster AWS competitiveness as it aims to drive AI-Native infrastructure capabilities across the telecommunications ecosystem. For more information, read the AWS blog by Ryan Niksch and Mayur Shetty.

Analyst Take

The Red Hat Telco Network Cloud (TNC) is a specialized reference architecture designed to help telecommunications operators deploy and manage 4G and 5G network functions across a hybrid cloud environment. At its core, the TNC utilizes a centralized Red Hat OpenShift management cluster to oversee various workload clusters distributed across the network. These workload clusters are tailored for specific functions, including 5G Core, Radio Access Network (RAN), virtualized 4G functions through OpenStack (RHOSO), and even dedicated environments for Artificial Intelligence Workload (AIWL) model training and serving.

A key feature of the TNC architecture is its ability to be deployed on Amazon Web Services (AWS) using the Red Hat OpenShift Service on AWS (ROSA). By utilizing ROSA, operators can maintain a consistent OpenShift environment across both public cloud and on-premises hardware, simplifying operational overhead and enabling robust disaster recovery strategies. For this specific implementation, a ROSA Classic architecture is preferred over the Hosted Control Plane (HCP) model because it supports the baremetal operator, which is essential for the automated provisioning of on-premises hardware.

The TNC Management cluster serves as the brain of the operation, providing Management and Orchestration (MANO) capabilities. It integrates several powerful tools: Red Hat Advanced Cluster Management (RHACM) for multi-cluster scaling and GitOps-based Zero Touch Provisioning (ZTP); Ansible Automation Platform (AAP) for complex configuration tasks; and Red Hat Quay to serve as a private container registry. These tools allow operators to automate the entire lifecycle of remote clusters, from initial deployment to long-term monitoring through a streamlined observability interface.

To maintain high security and accommodate disconnected or air-gapped on-premises sites, the TNC management cluster on AWS is typically designed as a Private ROSA Cluster. This configuration eliminates public internet ingress points, instead relying on internal load balancers and an AWS site-to-site VPN to connect the cloud-based management tools with the on-premises workload sites. This private tunnel handles critical traffic, including access to Baseboard Management Controllers (BMCs) for hardware control and secure communication between the central hub and remote spokes.

Effective communication across this hybrid estate requires precise storage and DNS configurations. The system leverages Amazon EBS for block storage and Amazon S3 for object storage, specifically supporting Quay’s image repository and RHACM’s observability data. Furthermore, bidirectional DNS resolution is established by configuring the ROSA cluster to forward queries to on-premises DNS servers, while the on-premises environment is updated to resolve the private AWS endpoints for the ROSA API, application routers, and S3 buckets.

The 2026 Telco Cloud Landscape: Competitive Strategies and AWS Advantages

For 2026, I see the telco cloud landscape as being defined by three primary strategic paths for 4G and 5G network orchestration. While the AWS-powered Red Hat TNC holds a solid position in the telecommunications sector, operators often weigh it against Microsoft's carrier-grade hybrid platform, Google's edge-optimized AI cloud, or European-led open-source frameworks.

Microsoft Azure Operator Nexus

Azure Operator Nexus serves as a purpose-built, carrier-grade hybrid cloud platform specifically for mission-critical mobile network applications. It is designed to automate the entire lifecycle of the infrastructure, including network fabrics and bare-metal hosts, within an operator's own data center. Many operators pair this with Azure Red Hat OpenShift (ARO) to achieve a management experience nearly identical to ROSA on AWS, making it a direct competitor for Tier-1 telcos such as AT&T and E& (Etisalat) who require deep Microsoft ecosystem integration.

Project Sylva (Open Source Framework)

For operators focused on digital sovereignty and avoiding vendor lock-in, Project Sylva offers a vendor-neutral cloud software framework. Initiated by major European telcos, Sylva standardizes the infrastructure layer so that network functions can be certified once and run anywhere. While Red Hat OpenShift is fully compliant with Sylva 1.5, the framework itself allows operators to use various underlying technologies (such as SUSE or Wind River) while maintaining a consistent European-validated standard for 5G and Open RAN (O-RAN) deployments.

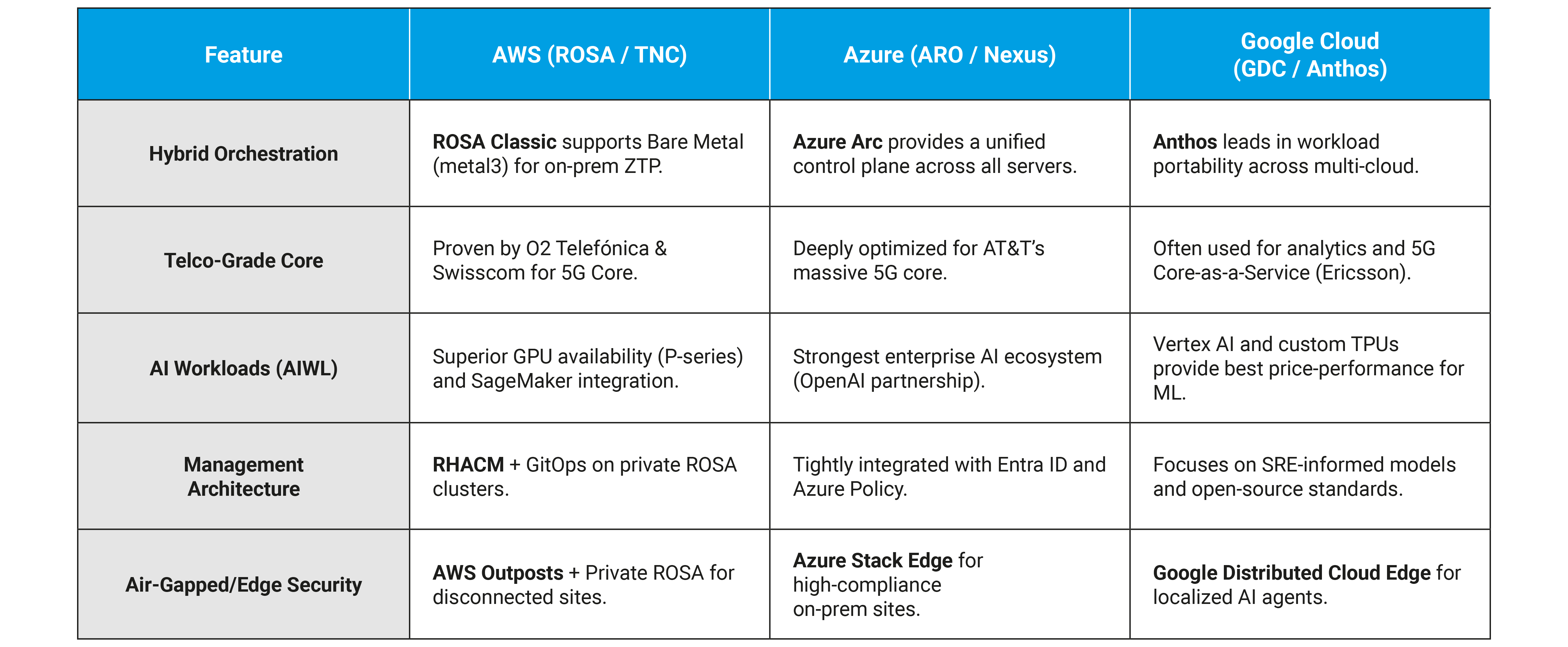

Feature-by-Feature Comparison

Using the Red Hat TNC reference architecture as a baseline, here is how AWS compares to its top competitors for 2026:

From my perspective, the strategic edge of AWS within the TNC framework is anchored by the ROSA Classic architecture, which provides essential support for the baremetal (metal3) operator. This specific capability is a primary differentiator, as it enables the Zero Touch Provisioning (ZTP) of physical, on-premises hardware. By facilitating this automation, AWS enables operators to orchestrate local physical servers with the same simplicity and fluidity typically reserved for public cloud instances.

Moreover, the AWS ecosystem provides a highly secure foundation for critical management tools like Red Hat Advanced Cluster Management (RHACM) and Red Hat Quay. By leveraging Amazon EBS for block storage and Amazon S3 through private interface endpoints, the TNC management cluster ensures that sensitive data, including container images and telemetry metrics, remains entirely within a private network. This localized data flow effectively eliminates exposure to the public internet, maintaining the high security standards required for disconnected or air-gapped telco environments.

By 2026, AWS has solidified its position as a market leader through a proven track record of successful commercial 5G core migrations. High-profile implementations, such as those with O2 Telefónica, demonstrate that the AWS 800G-ready infrastructure is fully capable of managing the high-bandwidth, low-latency demands of carrier-grade traffic. This established history gives telecommunications operators the confidence to transition mission-critical workloads to a hybrid model, knowing the platform can handle the scale and complexity of modern mobile networks.

2026 Outlook: ROSA with HCP and Price-Per-Watt Advances

A key part of the 2026 strategy is the move toward ROSA with Hosted Control Plane (HCP). While currently limited by its lack of bare metal support, the expected update in the first half of 2026 can enable telcos to offload the management of the control plane to Red Hat/AWS entirely, even for on-premises bare metal deployments. This can help reduce the operational tax on telco engineering teams.

Overall, the outlook for AWS in the telecommunications sector is positive as it moves toward becoming the primary AI-Native infrastructure provider. Beyond the technical shift to HCP, AWS is expected to capitalize on its 2026 infrastructure investments to bridge the gap between cloud-native agility and carrier-grade reliability. By integrating custom silicon such as the Tomahawk 6 and Silicon One directly into its telco-specific regions, AWS can potentially offer the most competitive price-per-watt for operators struggling with the massive power demands of 5G and AI workloads. This evolution positions AWS not just as a hosting provider, but as a strategic financial and technical partner capable of retiring AI infrastructure debt for global operators.

Ron Westfall | VP and Practice Leader for Infrastructure and Networking

Ron Westfall is a prominent analyst figure in technology and business transformation. Recognized as a Top 20 Analyst by AR Insights and a Tech Target contributor, his insights are featured in major media such as CNBC, Schwab Network, and NMG Media.

His expertise covers transformative fields such as Hybrid Cloud, AI Networking, Security Infrastructure, Edge Cloud Computing, Wireline/Wireless Connectivity, and 5G-IoT. Ron bridges the gap between C-suite strategic goals and the practical needs of end users and partners, driving technology ROI for leading organizations.